题目内容

(请给出正确答案)

题目内容

(请给出正确答案)

AggroChem Co is undertaking a due diligence investigation of LeverChem Co and is reviewing the potential bid price for an acquisition. You have been appointed as a consultant to advise the company’s management on the fi nancial aspects of the bid.

AggroChem is a fully listed company fi nanced wholly by equity. LeverChem is listed on an alternative investment market. Both companies have been trading for over 10 years and have shown strong levels of profi tability recently. However, both companies’ shares are thinly traded. It is thought that the current market value of LeverChem’s shares at higher than the book value is accurate, but it is felt that AggroChem shares are not quoted accurately by the market.

higher than the book value is accurate, but it is felt that AggroChem shares are not quoted accurately by the market.

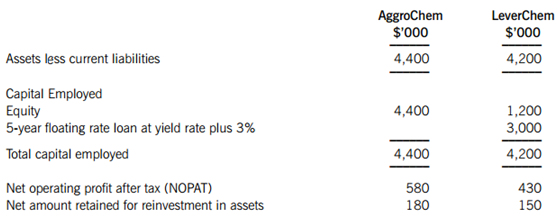

The following information is taken from the fi nancial statements of both companies at the start of the current year:

It can be assumed that the retained earnings for both companies are equal to the net reinvestment in assets.

The assets of both companies are stated at fair value. Discussions with the AtReast Bank have led to an agreement that the fl oating rate loan to LeverChem can be transferred to the combined business on the same terms. The current yield rate is 5% and the current equity risk premium is 6%. It can be assumed that the risk free rate of return is equivalent to the yield rate. AggroChem’s beta has been estimated to be 1·26.

AggroChem Co wants to use the Black-Scholes option pricing (BSOP) model to assess the value of the combined business and the maximum premium payable to LeverChem’s shareholders. AggroChem has conducted a review of the volatility of the NOPAT values of both companies since both were formed and has estimated that the volatility of the combined business assets, if the acquisition were to go ahead, would be 35%. The exercise price should be calculated as the present value of a discount (zero-coupon) bond with an identical yield and term to maturity of the current bond.

Required:

Prepare a report for the management of AggroChem on the valuation of the combined business following acquisition and the maximum premium payable to the shareholders of LeverChem. Your report should:

(i) Using the free cash fl ow model, estimate the market value of equity for AggroChem Co, explaining any assumptions made. (9 marks)

(ii) Explain the circumstances in which the Black-Scholes option pricing (BSOP) model could be used to assess the value of a company, including the data required for the variables used in the model. (5 marks)

(iii) Using the BSOP methodology, estimate the maximum price and premium AggroChem may pay for LeverChem. (9 marks)

(iv) Discuss the appropriateness of the method used in part (iii) above, by considering whether the BSOP model can provide a meaningful value for a company. (5 marks)

Professional marks will be awarded in question 2 for the clarity and presentation of the report. (4 marks)

请帮忙给出正确答案和分析,谢谢!

更多“AggroChem Co is undertak…”相关的问题

更多“AggroChem Co is undertak…”相关的问题

如果结果不匹配,请

如果结果不匹配,请